| « Memo to Congress: Invest More in Private Spaceships | Recent Dynamism » |

Call to Action to Stem the Mounting Federal Debt

04/14/10

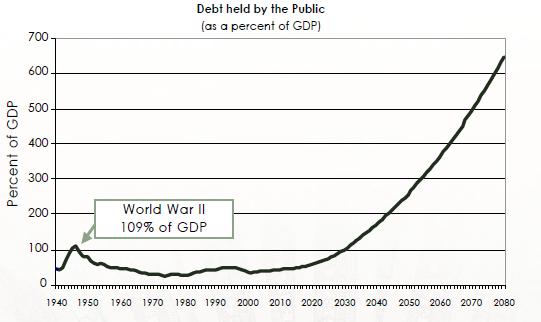

Currently, the U.S. National Debt Clock reads $12.8 trillion—the largest in history. To give a picture of just how much a “trillion” is: one could spend $10 million dollars per day, and not spend $1 trillion until 273 years. Nonetheless, over the past year alone, the U.S. Public Debt rose from 41 to 53 percent of Gross Domestic Product (GDP). With no dramatic shift in course, the debt is projected to grow steadily, reaching 85 percent of GDP by 2018, 100 percent by 2022, and 200 percent in 2038.

Data Courtesy of Forex Currency Trading & News Analysis

What is the Fear of a Rising National Debt?

With increasing debt, the danger lies in a debt-driven crisis in the United States, the tipping point of such a crisis is unknown, but the costs will be surely severe. Fears of inflation will decrease the value of the U.S. currency, leading to higher interest rates, shifting investments from the U.S. Treasury-denoted securities, and a more sluggish economy. Also, the rising debt would make it more difficult to finance emergency spending; the U.S. is becoming more reliant on oversees lenders, who already are expressing concerns about the fiscal management of the United States.

Follow up:

The excessive debt would also harm the American standard of living through slower economic growth, declining wages, and probably higher taxes. These factors, along with depreciation in the value of U.S. currency, hurts the U.S. in an increasingly competitive global economy.

The Current Deficit

The annual deficit, which is only projected to continue increasing, is a problem that needs to be treated as soon as possible. Otherwise, unpleasant consequences would poison our economy: first and foremost, the debt will continue to grow with incredible rates, leading to substantial problems. In 2009 the budget deficit was $1.4 trillion, about 10 percent of the GDP, and is predicted to reach 16 percent of GDP by 2038.

The recent economic recession, along with the 2001 slump, are major contributions to the current deficit. Reduced tax revenues have failed economists who predicted otherwise, leading to budget deficit. But there are other factors to consider: blame placed on bills and policies signed by Mr. Bush, which were extended by Mr. Obama, such as cuts in taxes, the wars oversees in Iraq and Afghanistan, and so on. But more broadly, the extension of a number of deficit-financed policies: rising unemployment rates, demographic changes (e.g. the ageing Baby Boomers), and growing health care costs are major contributors.

Is There a Way Out?

Solving this problem will require difficult systemic changes, but remains possible. For example the Peterson-Pew Commission on Budget Reform has recommended a six-year plan for Congress and the White House to adopt in the medium and long-run. The recommendations include:

- Stabilizing the total debt to within 60 percent of GDP by 2011

- Specifying a credible stabilizing track this year to reduce the annual deficit to within 2 percent of GDP

- Beginning policy changes by 2012

- Implementing an enforcement regime to stay on track over the long-run

Whatever the solution is, the way out of this situation is going to be long and bitter for everyone: most experts suggest that the core of a solution is tax increases and spending cuts. However, this is better than the alternatives previously discussed. Taking all of this into consideration, the problems looming in the horizon are frightening. Serious actions to restore fiscal responsibility need to be taken as soon as possible, to avoid long-term debilitating economic woes.

No feedback yet

Comments are closed for this post.